Compute As Money

Money wasn’t humanity’s first economic system – most early societies ran on credit, debt, and obligation, with barter playing a marginal role. But eventually, nearly every stable civilization converged on money, and for good reason: money is universally convertible. It can be exchanged for almost anything else – labor, resources, goods, influence. Convertibility is what makes money powerful.

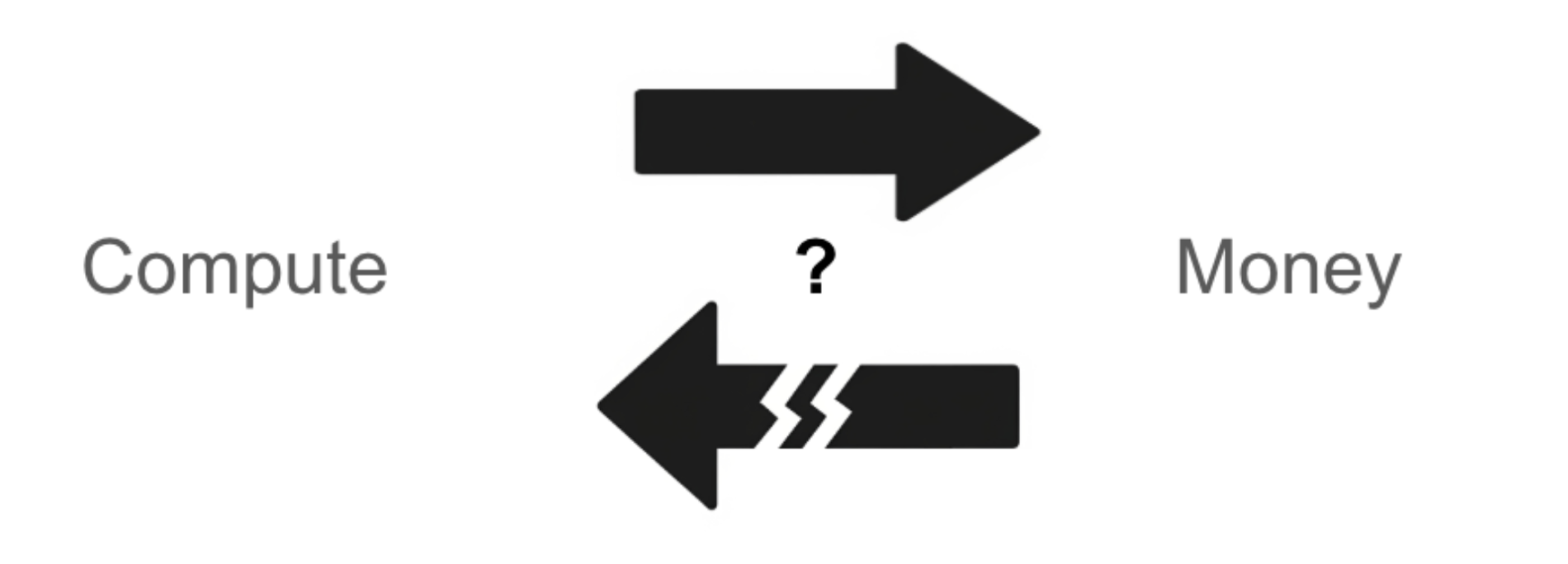

Now, consider what happens with the possible advent of artificial general intelligence… A truly general AI, paired with sufficient compute, achieves its own form of universal convertibility. It can perform labor directly and it can help acquire resources (especially in concert with robotics). It can generate influence – sometimes quite directly, by communicating persuasively with the people you wish to influence. In other words, compute becomes exchangeable for nearly anything money can buy, just through a different mechanism.1

In fact, compute might be even more convertible than money – if compute and AI can help obtain money, but money cannot always buy access to compute. This could happen if the compute is held by nation states or other entities that enforce restrictions on access.

What does this all mean?

- Does money get supplanted?

- Will compute become more valuable than money?

How compute is not money

To be clear, compute does not cleanly fit existing definitions of money.

Properties of money

These are generally accepted functional criteria for money:

- a “medium of exchange” – it should be widely accepted as payment for goods and services.

- a “unit of account” – it should provide a standardized measure of value.

- a “store of value” – its value should not change (much) over time.

Certain properties of money help enable those functions. E.g. fungibility (all money with the same value is interchangeable), divisibility (you can make the values almost arbitrarily small), portability (can be easily moved or change hands), and durability (maintains its form over time). These properties hold especially true for the current digital form of money.

It’s great when money has these properties and functions, because they allow people to operate in an economy and easily make trades, without incurring lots of extra cost. They enable money to be better than barter, because trades can happen even if two parties don’t have resources they simultaneously want from each other (the “double coincidence of wants”). They also enable money to be better than debt/credit, because it allows trades even if one side wouldn’t trust the other to repay in the future.

Properties of compute

It’s not clear that compute would have these properties and functions. Let’s consider two forms:

- The compute infrastructure itself (possibly including contingent infrastructure like electricity generation, electrical grids, telecommunications, affordances for inputs and outputs).2

- Credits that give you access to compute infrastructure (e.g. token credits on a cloud).

| compute infrastructure | compute credits on a cloud | |

|---|---|---|

| fungibility | Compute hardware is highly heterogeneous. And even identical chips can perform differently based on network, memory, location (latency), time of day, etc. ❌ | « Ditto ❌ |

| divisibility | Infrastructure generally has a minimum viable scale and is not divisible – this is a large part of why cloud computing arose in the first place ❌ | Credits could potentially be priced in a very divisible way, e.g. via FLOPs, tokens, or compute hours. ✅ |

| portability | Hardware is not easy to move, though there may exist markets for trading ownership and control over hardware. | Credits will likely won’t be accepted across providers. However, you could conceivably transfer your credits to other owners. ✅ |

| durability | Hardware is not physically durable, and can fail or degrade over time. ❌ As with fiat money, the value of compute can rise or fall over time. We will return to this later. |

Credits may have some expiration, but will likely be durable over medium periods of time, like money. ✅ «Ditto re variability of value |

Compute credits could fulfill more of these properties than compute infrastructure, and thus be more likely to fulfill the functions of money. However, neither fits the bill perfectly.

The mechanisms underlying convertibility are different

Another way to understand the above is that compute (when combined with AI) gains its power from quite a different mechanism than money. Money is convertible because other people, institutions, and governments accept it within a market (largely because of the above properties). But compute is convertible because AI does work to generate your desired results and resources (thus “converting” the compute), not because other people accept it within a market (though maybe they might also).

Alternate framings

1. Compute as commodity or capital good

In a post-AGI world, perhaps compute will have a function more similar to today’s commodities, such as gold, silver, timber, oil, and precious metals. It may act like a commodity, being scarce, having price volatility, and being tradable in units. It may also act like a capital good (an input that yields output and can accumulate to build advantage).

2. Compute enabling “labor as an asset class”

AGI may also enable a new asset class for investment, adding to existing categories like equities or real estate. Currently, it’s challenging to invest in labor directly as an asset class – you can’t directly buy shares in someone’s future earnings, the way you can buy shares in a company or a piece of real estate. You can invest in your own human capital. Or you must build a company, hire employees, train them, and employ their labor towards building some product. AI could fundamentally change this.

Nonetheless, could compute credits (or some derivative) become a commodity currency?

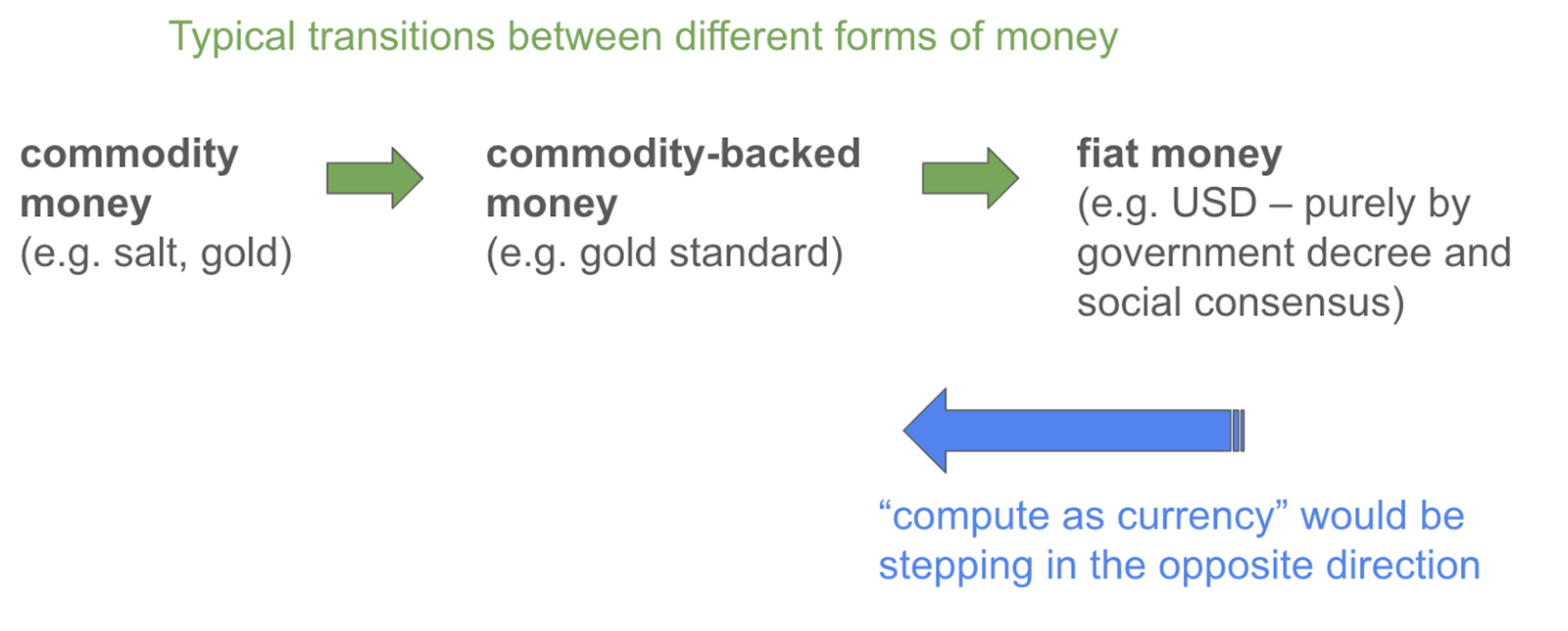

Currently, most of the world operates on fiat money, which is not tied to any kind of commodity and has no inherent value. In contrast, compute would be a form of commodity money. This was more common in the past (e.g. salt was used to pay Roman soldiers, giving rise to the modern word salary). Alternatively, it could form the backing for a new currency, as we’ve had in the past, e.g. with gold and silver standards.

As a broad generalization, societies tend to move from commodity to commodity-backed to fiat money. Moving from fiat money to compute would be stepping in the opposite direction. However, this reversal has occurred many times in history. Just a few examples:

- China 1910s: Although China was likely the first to develop paper money and then fiat money in the 1000s-1300s, the country saw the resurgence of silver money in the 1910s after the fall of the Qing dynasty.

- Zimbabwe 2024: Facing hyperinflation and multiple currency crises, the country issued a gold-backed currency, the ZiG (Zimbabwe Gold).

- Kenya 2000s: Many Kenyans lacked access to traditional bank accounts, and began using mobile phone minutes as currency instead. (This is a very interesting story – it eventually led to the development of M-Pesa, the hugely popular phone-based money transfer service.)

So how likely could this be, where compute becomes the commodity basis of a new currency?

A few factors that could determine the answer:

- The stability of existing institutions. As we see above, there are lots of historical examples of societies moving away from fiat to commodity-based currencies, but mostly in cases of weak institutions or societal / economic collapse. This will likely differ for different regions of the world. (Also see weak financial institutions as drivers of cryptocurrency adoption in many countries.3)

- Ability to fulfill the functional criteria previously listed. This depends a lot on the particular future form. Would compute credits be easily transferable between owners? Would there exist some market for trading ownership or control of compute infrastructure? Will the technology converge to a single form of hardware that leads it to be more uniform and exchangeable?

- Whether there would even be an economy outside of AI. If most or all the economy runs on AI, then it might make sense for currency to take a form that is more “native” to AI. This may be less true if large parts of the economy do not involve AI.

- Which would become more valuable to hold. See next section.

Would money or compute be more valuable?

If I were to allocate my holdings to one or the other, which one should I choose?

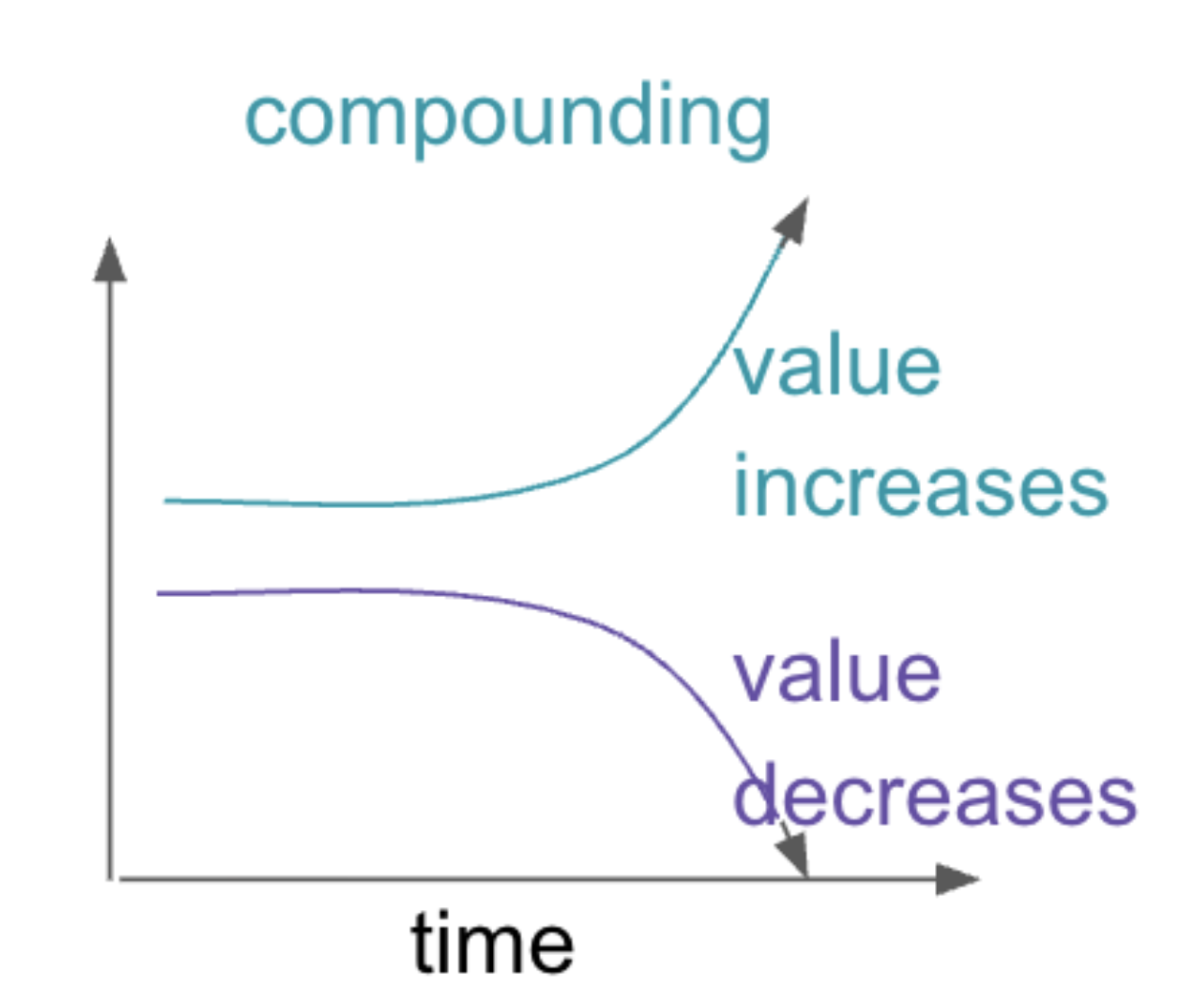

Money and compute can both gain or lose value over time.

Money: Generally speaking, there are natural inflationary dynamics for markets and monetary systems, but also this is explicitly the monetary policy of most central banks (e.g. targeting around 2% inflation). Money can certainly enter deflationary periods as well.

Compute: Historically, compute has often been deflationary. It loses value with wear and tear, and as technology improves (making old hardware obsolete). It can also lose value if supply grows faster than demand. On the other hand, if demand grows faster than supply, compute could gain value over time (a plausible scenario, as we’ve already seen in some cases). Compute could also gain in value as AI becomes more powerful or efficient (X flops or X GPUs gives you more value, because the AI can do more with a given unit of compute).

At the same time, if we land in an economy that consists largely of AIs, and AIs are the consumers of other AIs’ outputs, then AI becomes both the supply and the demand (similar to how humans comprise both sides in the current economy). Then supply and demand grow in lockstep, and we see neither inflation nor deflation of compute’s value.

Returns on money and compute can both compound, if invested well. Money and compute can both be used to obtain more money and compute, which can then be used for further returns.

It’s unclear: How quickly does each curve bend? How fast do they bend relative to the other, for both compute and money? The (expected) relative balance between these dynamics will determine which is more valuable to hold. (These dynamics also determine how well compute fulfills the “store of value” function of money – whether the value of compute remains stable.)

Takeaways

Money has a powerful coincidence of properties and functions, which compute may not necessarily hold in a world with AGI. Thus, compute may or may not displace current forms of money. This possibility likely depends on e.g. the future form of hardware, the size of the non-AI economy, and societal / institutional stability. It may also vary in different regions of the world. Most certainly, compute may hold status as extremely desirable commodity, capital good, or asset class.

In any case, AGI may cause compute to have its own form of universal convertibility – giving access to resources, labor, and influence. It may even become more convertible than money, if access restrictions are placed on compute, and you can’t buy arbitrary compute with money. Even if this convertibility arises from a different mechanism, owning compute will be incredibly valuable and powerful, just like owning money today.

Acknowledgements

Many thanks to Phyllis Sun, John Klopfer, and Raja Patnaik – three economist friends who graciously engaged with me on this writing and provided invaluable input. Thanks also to Jordan Fisher for very helpful feedback.

P.S. if you are an economist reading this, we need your help in thinking about these topics! There is so much more to explore. If you know you could have done better on any part of this analysis, please lean in to that feeling :)

-

It’s also convertible in the more classic sense, of course, because it can be sold or traded on a market. But the interesting thing here is that it has power and convertibility before you ever sell it. ↩

-

It might seem like compute has a lot of dependencies that money doesn’t have, e.g. on infrastructure and institutions and technological progress. But money also has dependence on institutions, financial infrastructure, and society stability, as we discuss a bit more here. ↩

-

Note that compute and energy are already a form of currency due to proof-of-work cryptocurrencies like Bitcoin, though they are not widely adopted, and many cryptocurrencies use other mechanisms such as proof-of-stake. ↩